How to donate efficiently to LMIC organisations

Introduction

Often when donating to LMIC charities directly through bank transfer, a non-negligible amount of your money will likely be lost through intermediary bank fees, poor exchange rates or other fees. This can range from 1% to an egregious 20%. This guide aims to help minimise the amount of money lost in this process.

Note: This guide does not take into account tax deductibility which would likely be a superseding factor compared to transfer fee efficiency. Our experience stems from operating within the African landscape, particularly in transferring funds to various animal advocacy charities and projects across Africa, but we think this could also be highly applicable to other organisations working in low, middle income settings.

Advice for Sending Money Efficiently

Use Wise

My first and primary piece of advice in this guide is to sign up to and use Wise. Wise has the best exchange rates and the highest level of transparency I have come across, usually averaging out to around a fee of 0.7% for a one-way money exchange and transfer. In other words, donating $100 to a Mexican organisation would cost you ~$0.7 so they would end up receiving $99.3 instead of $100.

Go through as few entities as possible

I’d recommend making as few transactions as possible and going through the least number of intermediaries. This is because often there is a fee associated with each step of the transaction. So if you can make a direct transaction, that is optimal.

For example, if you do a direct bank transfer, your transfer may be routed through additional intermediary banks each charging their own fee, or if donating through an intermediary third party donation website they may take their own fee, so it’s worth checking if this is the case. This could be by asking the recipient or referring to the donation website.

Send in the same currency as the recipient

This is generally good practice because you’ll know what exchange rate you’re paying when you exchange the money to the same currency as the recipient. Otherwise, you will pay the exchange rate the banks set unknowingly, which can be unfavourable, especially if it takes place on the recipient’s side.

I recommend asking if the receiver has a USD account (assuming you are sending in USD) or if it’s possible for them to set one up, especially if you are making large or multiple transactions and then sending in USD.

If you are not sending in USD it may make sense to exchange to the currency the recipient is using, to avoid conversion on the recipient's end of the transaction

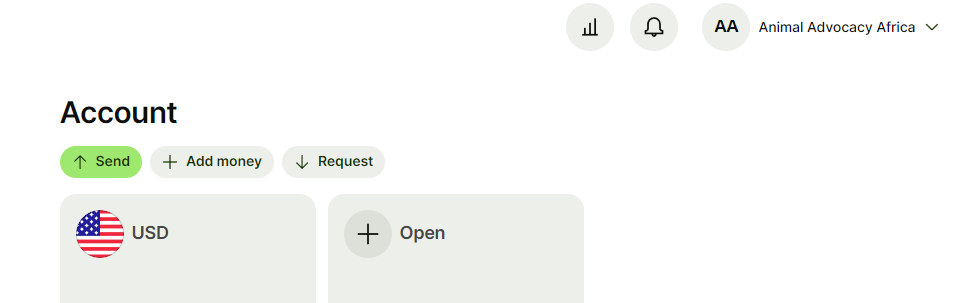

Fortunately, in Wise, this is relatively easy. You can open a new account in most currencies (see image below). Once you have this new account you can exchange money into this account from your existing USD (or primary currency) account at a good rate.

Opening a new account balance in a different currency is simple with Wise. Open –> Choose your currency –> Confirm

Other Options

Sometimes Wise will not work, for example as I am writing this you cannot send to Nigerian recipients. My current best solution for this is using WorldRemit, which does work, although the fees are high. Unfortunately, sometimes you will have to accept paying a high fee for the sake of expediency.

In general, I have ordered this list with the lowest fee options first and progressing to those with the highest fees. (Take this with a pinch of salt and please do your own research as this is anecdotal to my own experience)

SendWave

SendWave has fair rates and covers a fair amount of countries across Africa, Asia, and Latin America. It is worth checking SendWave, if Wise does not have your country covered.

Caveat: I don’t recommend using cash pickup unless it is your absolute last option. It can be potentially unsafe for the recipient.

WorldRemit

As I mentioned above, WorldRemit often has countries covered that Wise does not. It’s worth checking, if neither SendWave nor Wise has you covered.

Bank Transfer

Often you are losing a fair bit of money on bank transfers. That said, if your bank has excellent transparency and foreign exchange rates, it could be a viable option.

Paypal

It’s unlikely PayPal will work better than any of the above options due to high fees but it can be worth checking.

Forex Company

I have tried to sign up with a couple of different FX companies and they both oversold and underdelivered. I could imagine if you are doing substantial transactions they may prioritise you and give you a better rate. Feel free to email me for information on my experience with Forex companies.

Another Regrantor

Piggybacking off of another re-grantor like ourselves (Animal Advocacy Africa for transfers to animal advocacy organisations in Africa) who has optimised systems and transfers set up can cost less and be a smoother process, although you may incur further costs from going through multiple entities.

Recommended Resources

EA Operations Slack - They do have some membership Criteria Here, Apply to join here, but there are multiple threads on the matter

Feel free to contact me if you have any questions: cameron@animaladvocacyafrica.org

Want to learn more about our work and the African animal advocacy landscape? https://www.animaladvocacyafrica.org/